Zero2IPO Industry Investment was founded in 2012. It focuses on providing listed companies, family enterprises and local governments with strategic industrial distribution and middle and long-term asset management and investment services.

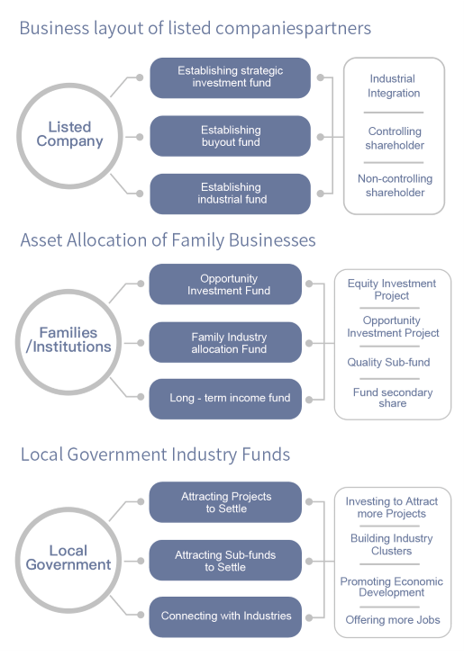

Zero2IPO Industry Investment and listed companies set up strategic industrial funds to assist listed companies in industrial layout and market value management; Through private equity market investment, Zero2IPO Industry Investment provides medium-and long-term asset allocation services for family businesses to find new opportunities for industrial integration, thus realizing wealth increase and industrial layout. Zero2IPO Industry Investment also establishes industry investment funds with local governments, attract leading enterprises in their industry to settle, and speed up the adjustment of local economic structure and the coordinated development of regional economy. At present, Zero2IPO Industry Investment manages dozens of strategic funds of listed companies and family funds, with an AUM of 20 billion yuan.

Based on Zero2IPO Group’s in-depth understanding of China's private equity industry and all-inclusive services covering research, conference, advisory and investment, Zero2IPO Industry Investment taps the value of enterprises and market by means of active management to achieve value investing.